fha home loan california guide for first-time buyers

What an FHA loan offers

The FHA program can make homebuying in California more attainable, with lower down payments (often around 3.5% for qualified borrowers), flexible credit standards, and competitive fixed rates. You’ll pay mortgage insurance, which helps lenders extend credit but adds to the monthly cost, so budget carefully.

California considerations

Because prices vary widely from coastal cities to inland areas, county loan limits differ across the state. Some condos require FHA approval, and the property must meet safety and livability standards. Also plan for higher taxes, insurance, and potential HOA dues common in many communities.

How to prepare

Set a realistic price range, gather income and asset documents, and compare at least three lenders. A thorough pre-approval strengthens offers in competitive markets and helps you understand your true payment.

- Verify your county’s current FHA loan limit before shopping.

- Estimate total payment, including MIP, taxes, and insurance.

- Explore down payment assistance or grants available locally.

- Request a lender credit or seller concession to offset closing costs.

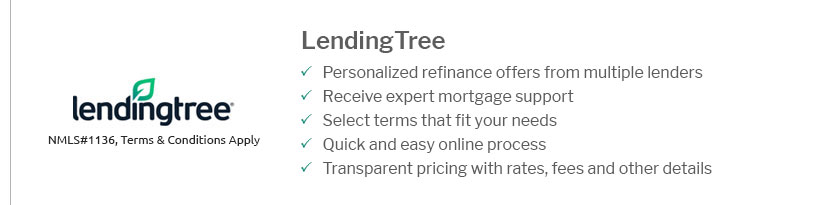

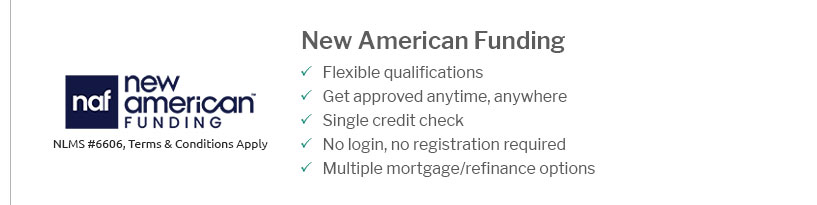

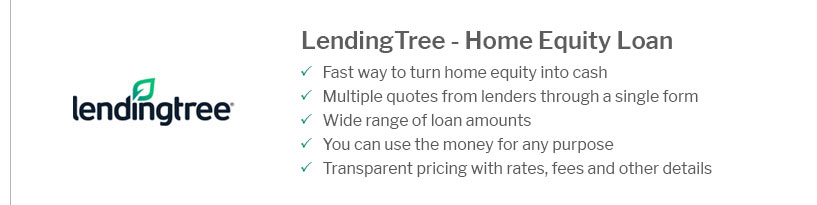

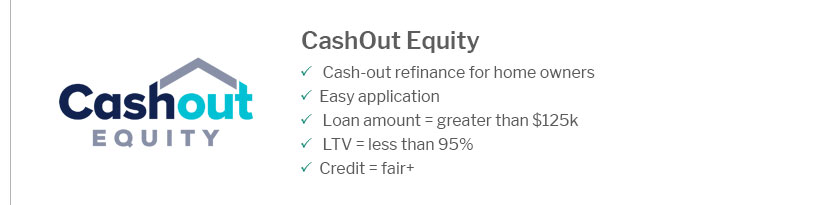

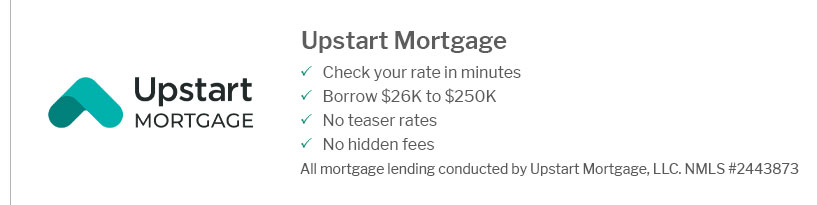

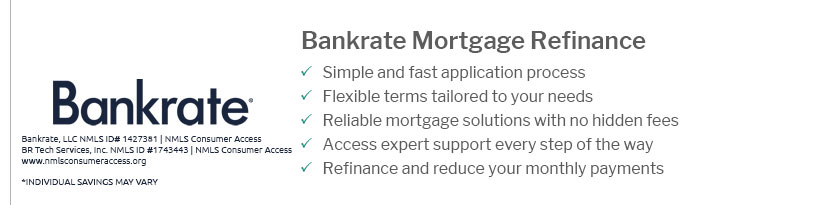

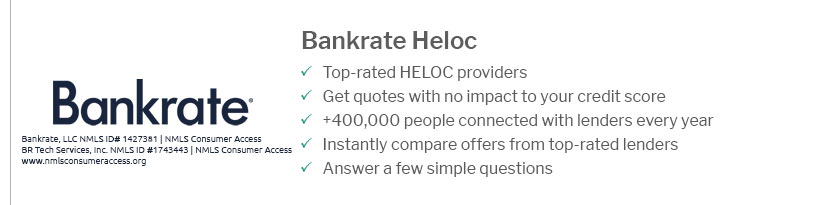

- Revisit refinancing options as equity and credit improve.